Nature strategies made easy.

Darwin helps businesses and consultants assess

and reduce biodiversity footprints.

The problem.

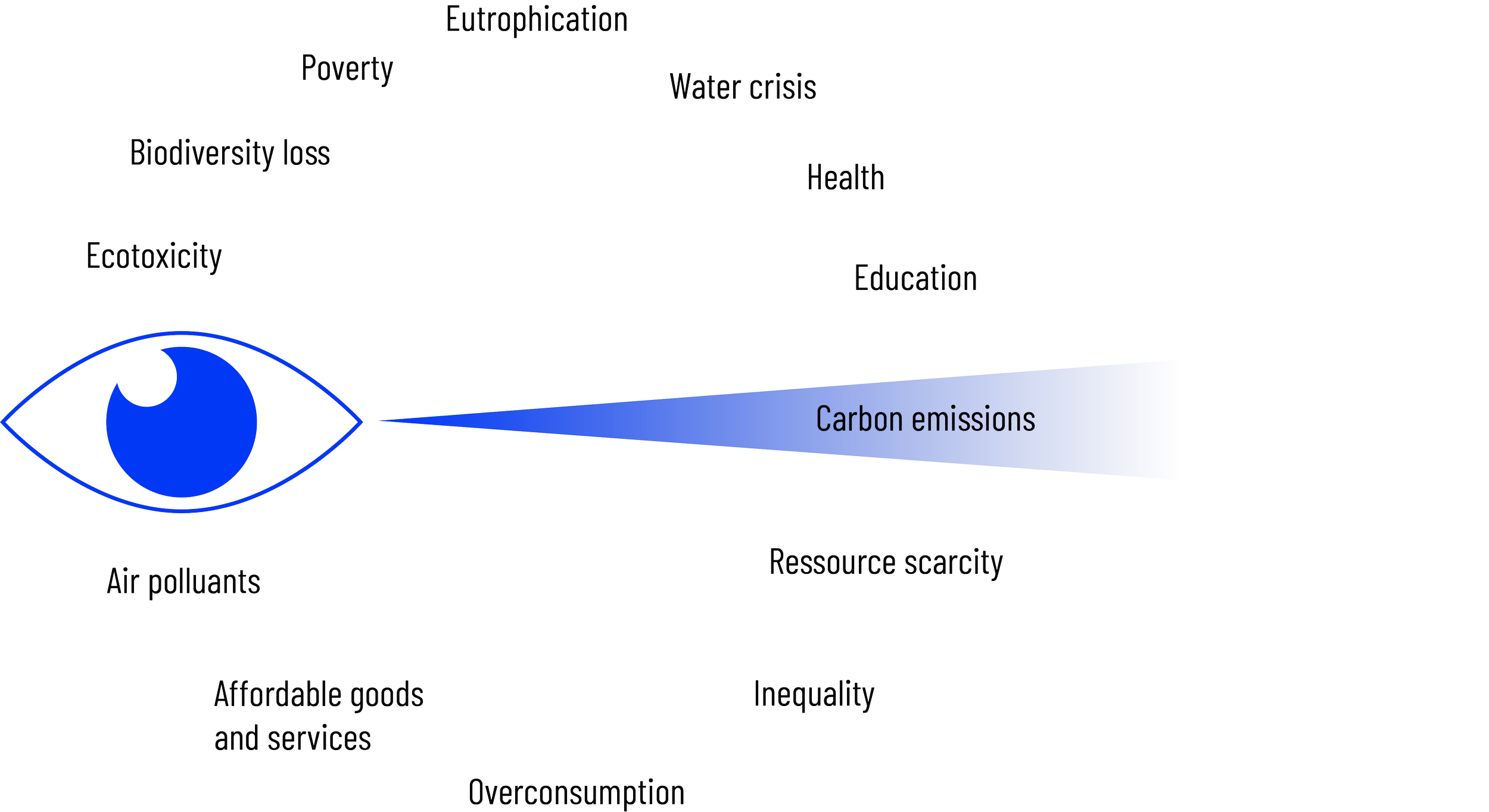

Environmental challenges are too often approached in silos. We hear about the climate crisis, the biodiversity crisis, or the water crisis as separate issues, when in reality they are deeply interconnected.

Historically, businesses have prioritised measuring and reducing GHG emissions, frequently overlooking other critical environmental pressures.

This is changing: businesses are now increasingly integrating biodiversity into their strategies, driven by evolving regulations and a growing understanding of the risks associated with nature loss.

Our approach.

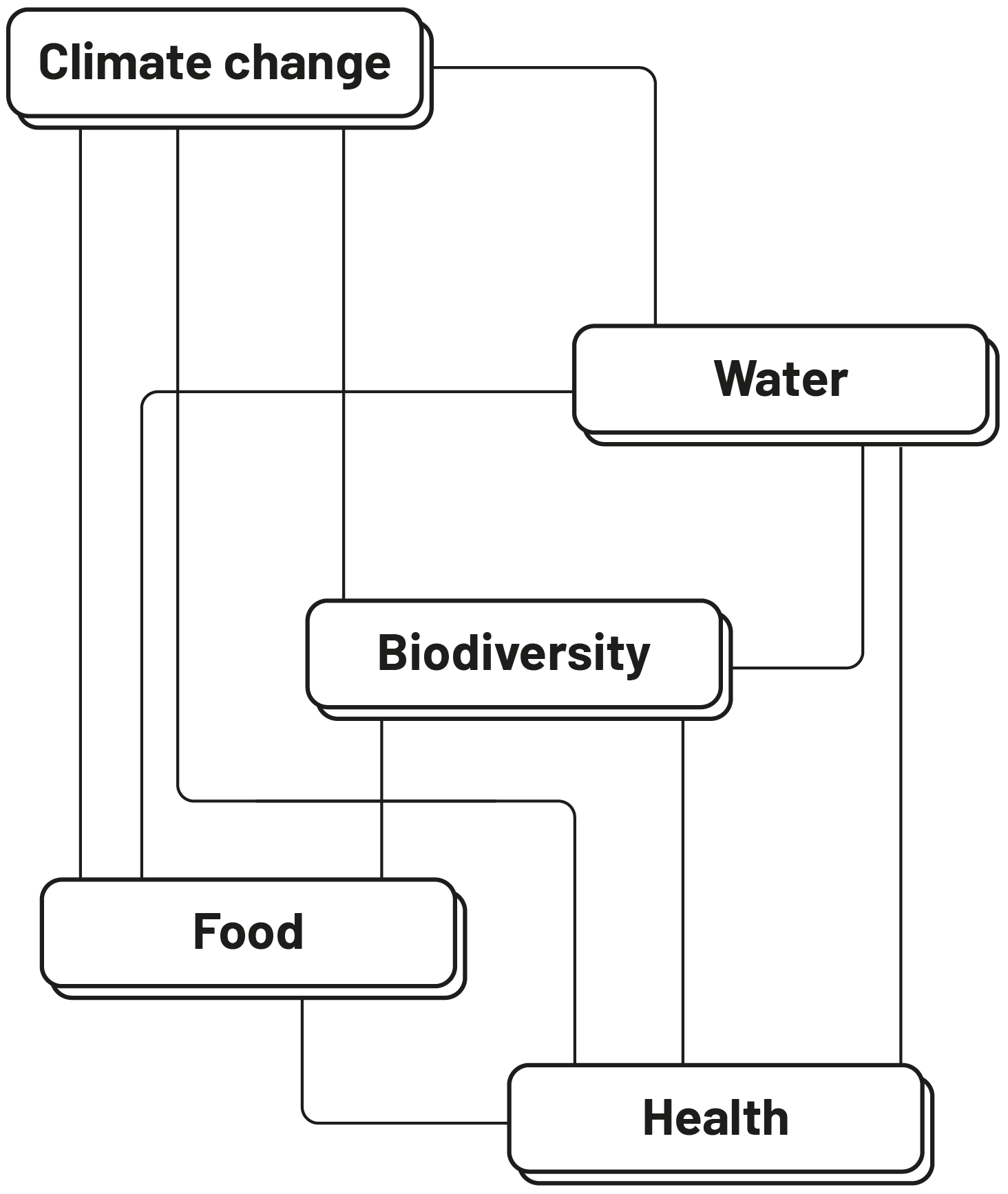

At Darwin, we recognize the intricate connections between biodiversity, water, food, health, and climate change—the five elements of what the IPBES refers to as the “nexus.”

Our methodology assesses the impacts, dependencies, and risks linked to nature by taking into account the full complexity of the Earth’s system. We leverage the IPBES framework of five key environmental “pressures” (the main drivers of change in nature) to provide a more holistic approach.

We advocate for breaking down single-issue silos through integrated and adaptive decision-making. By doing so, businesses can set meaningful targets and take actionable steps to transition toward a nature-positive economy.

Our platform leverages cutting-edge technologies

to support nature strategy design.

Featured in

Our product.

Our platform and API are highly flexible.

Our modules cover every stage of nature strategies, from data collection to footprinting, spatial analysis, target-setting, action planning, and reporting.

We leverage advanced technologies — big data, AI, and geospatial intelligence — to streamline the entire process and make it scalable.

Our value proposition.

Optimise sourcing & procurement

Identify top raw materials, flag high risks commodities & suppliers and improve traceability.

Improve supply chain resilience & resources efficiency.

Design distinct nature strategies

Ground ESG claims in data and move beyond qualitative statements.

Align targets with measurable baselines to feed ESG reports and coms.

Showcase positive or avoided impacts.

Mitigate nature-related risks

Identify physical & transition risks related to nature & biodiversity.

Pinpoint top priority sites.

Quantify & mitigate financial risks exposure.

Comply with regulation & tenders

Streamline nature reporting (e.g. Corporate Sustainability Reporting Directive - CSRD or Taskforce on Nature-related Financial Disclosures - TNFD).

Meet biodiversity criteria in tenders and client requirements.