Investing with Nature in mind: how to integrate biodiversity into due diligences

Biodiversity is rapidly becoming a central theme in sustainable finance. Once peripheral to ESG screening, it is now emerging as a core dimension of investment risk management and opportunity identification. From large generalist funds to impact-oriented investors, the financial community is beginning to understand that biodiversity loss is not just an environmental concern — it’s a business risk.

In this article, we explore how biodiversity should be integrated into ESG due diligences and how investors can turn these assessments into actionable insights. We have illustrated two different cases: high-level ESG due diligences integrating biodiversity and in-depth biodiversity due-diligences.

Biodiversity Due Diligence for generalist funds

For most generalist funds, biodiversity is still treated as one component of the broader “E” in ESG, alongside climate, water, or pollution. Yet it is fast becoming a differentiating factor for identifying risk-exposed or transition-ready companies. Those funds typically conduct a high-level biodiversity DD.

Why include biodiversity?

Risk management. Biodiversity loss amplifies physical and transition risks. Funds now seek to identify companies exposed to deforestation, water scarcity, or resource depletion and to quantify their dependencies on natural capital.

Regulatory anticipation. Frameworks such as the SFDR, Article 29 LEC, and TNFD are pushing investors to integrate nature-related data at fund level. Early movers are starting to collect consistent metrics to prepare for aggregated fund reporting.

Opportunity mapping. Beyond risk, biodiversity opens opportunities: companies enabling ecosystem restoration, circular materials, or sustainable agriculture are increasingly attractive for nature-positive portfolios.

What should be assess?

Most ESG due diligences now include a biodiversity materiality section — a first step to identify potential impacts and dependencies. This typically covers:

The company’s relationship with ecosystem services and environmental pressures (land use, pollution, water).

Red flags such as sites near protected areas, exposure to deforestation or controversial inputs such as pesticides, or intensive water use in stressed regions.

How? From data to insights

Traditional DD questionnaires used by funds usually rely on generic biodiversity questions. They provide a broad sense of exposure but fail to capture actual impacts on ecosystems. Metrics often depend on indirect proxies which tell little about local biodiversity.

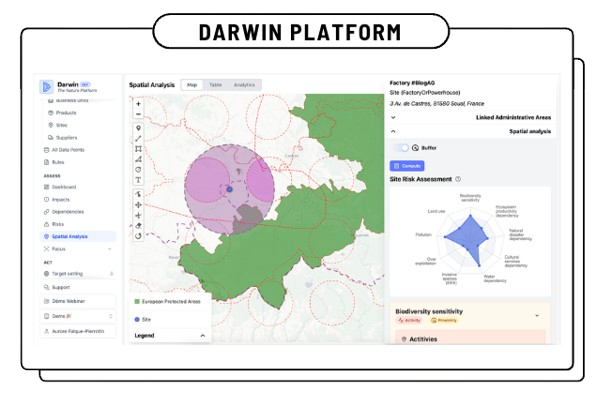

With tools like Darwin, biodiversity DDs can go further:

Leverage existing, easy-to-access data — financial and product data for sectoral materiality, combined with site locations for spatial analysis.

Cross-reference with third-party datasets available on the platform:

High-risk commodities (HICL, EUDR)

Proximity to protected or sensitive areas

Deforestation fronts

Water stress zones

The result: a data-driven view of exposure that links the company’s footprint to concrete biodiversity risks and dependencies.

Biodiversity due diligence for impact-oriented funds

For impact funds, biodiversity is not just a risk factor: it’s part of the investment thesis itself. These funds aim to demonstrate that their capital generates measurable positive outcomes for nature. The DD typically goes into deeper details.

Why go further?

While the motivation still includes risk management and regulatory readiness, impact investors add a third dimension: proof of impact. They need to quantify how their investments contribute to ecosystem restoration, sustainable sourcing, or pollution reduction.

What’s assessed?

Negative, positive, and avoided impacts on biodiversity — quantifying both pressures and benefits.

Key enablers of progress, such as regenerative agriculture, habitat restoration, or sustainable water management.

KPIs and impact roadmaps, used to monitor biodiversity outcomes post-investment.

How? From data to action

Using Darwin to power such DD, the approach typically involves:

Building granular baselines (i.e. business-as-usual scenarios).

Locating positive impact areas such as restoration projects or supplier transitions.

Translating results into operational KPIs that guide portfolio companies and demonstrate measurable improvement over time.

From compliance to strategy

Whether for generalist or impact funds, biodiversity due diligence should ultimately add value — not just tick a box. As a result, we strive to:

Stay pragmatic. Build on existing data sources such as carbon assessments, ESG reports, or life-cycle analyses rather than reinventing everything.

Link biodiversity to business reality. Connect nature indicators with financial and operational KPIs — from supply-chain sourcing to product innovation.

Turn DDs into strategic levers. A biodiversity footprint can inform sourcing, M&A decisions, and long-term fund resilience.